Our Process

Step One: Discovery Meeting

Whether we meet on Zoom or in person, this first step is all about getting to know each other. I’ll learn about your current situation, what’s working, and what challenges you’re facing. If you’ve worked with an advisor before, we’ll talk about what you liked or didn’t like. If this is your first time, we’ll cover what you’re hoping to get out of the relationship.

You’ll also have the chance to ask me questions about how I work, what you can expect, and how I support clients over the long term.

The goal here is simple: to see if we’re a good fit for each other and to set the foundation for a strong, ongoing relationship.

Step Two: Financial Deep Dive

This is where we roll up our sleeves and really get to know your situation. To give you advice that actually fits your life (instead of cookie-cutter answers), we’ll ask for details like:

Income & Expenses – what’s coming in and what’s going out month to month.

Taxes – a look at your most recent return and how you’re handling estimated payments.

Current Investments – 401(k)s, IRAs, brokerage accounts, company stock, etc.

Insurance Coverage – life, disability, health, home, auto.

Debt – student loans, credit cards, mortgages, or business loans.

Assets – home(s), rental properties, savings, business ownership.

Goals & Priorities – the “why” behind the numbers (travel, retirement, family security, buying a house, starting a business, etc.).

Step Three: Building The Plan

This is where everything comes together. Using the details we gathered, I’ll put together a plan that’s built around what matters most to you. That could mean:

Buying a home – making sure the numbers work and you’re financially ready.

Investing wisely – aligning your portfolio with your goals and risk tolerance.

Saving on taxes – finding strategies to keep more of what you earn.

Clarity & confidence – knowing exactly where you’re headed and what steps to take next.

The goal isn’t just a stack of charts and numbers, it’s a roadmap that feels doable, tailored, and gives you confidence moving forward.

Step Four: Taking Action

This is where the rubber meets the road. Once we’ve built your plan, I’ll give you clear, prioritized steps so you know exactly what to do first, second, and third. We’ll break things down into manageable pieces. Whether that’s adjusting your 401(k) contributions, setting up an emergency fund, or reworking your insurance.

If you’ve chosen to have me manage your investments, I’ll take care of getting everything set up in your accounts through Altruist and making sure your money is working for you. Beyond investments, I’ll check in with you as you implement other parts of the plan, keep you accountable, and make sure you never feel like you’re doing it alone.

The point isn’t perfection. It’s progress, step by step.

Step Five: Ongoing Support

Life doesn’t stand still, and your plan shouldn’t either. As things change (new job, new house, growing family, market shifts), we’ll revisit your plan together and adjust as needed.

We’ll meet regularly to:

Review your progress

Update goals and priorities

Adjust investments or tax strategies

Keep you on track no matter what life throws your way

Think of it like having a financial coach in your corner, making sure your money always supports the life you want.

High Tech Tools

One of the perks of working with a modern advisor is getting access to the best tools available. I use industry-leading software to make your financial life easier and more organized:

RightCapital

Interactive financial planning so you can see your future in real time.

Elements

A simple app that tracks your progress and keeps us connected between meetings.

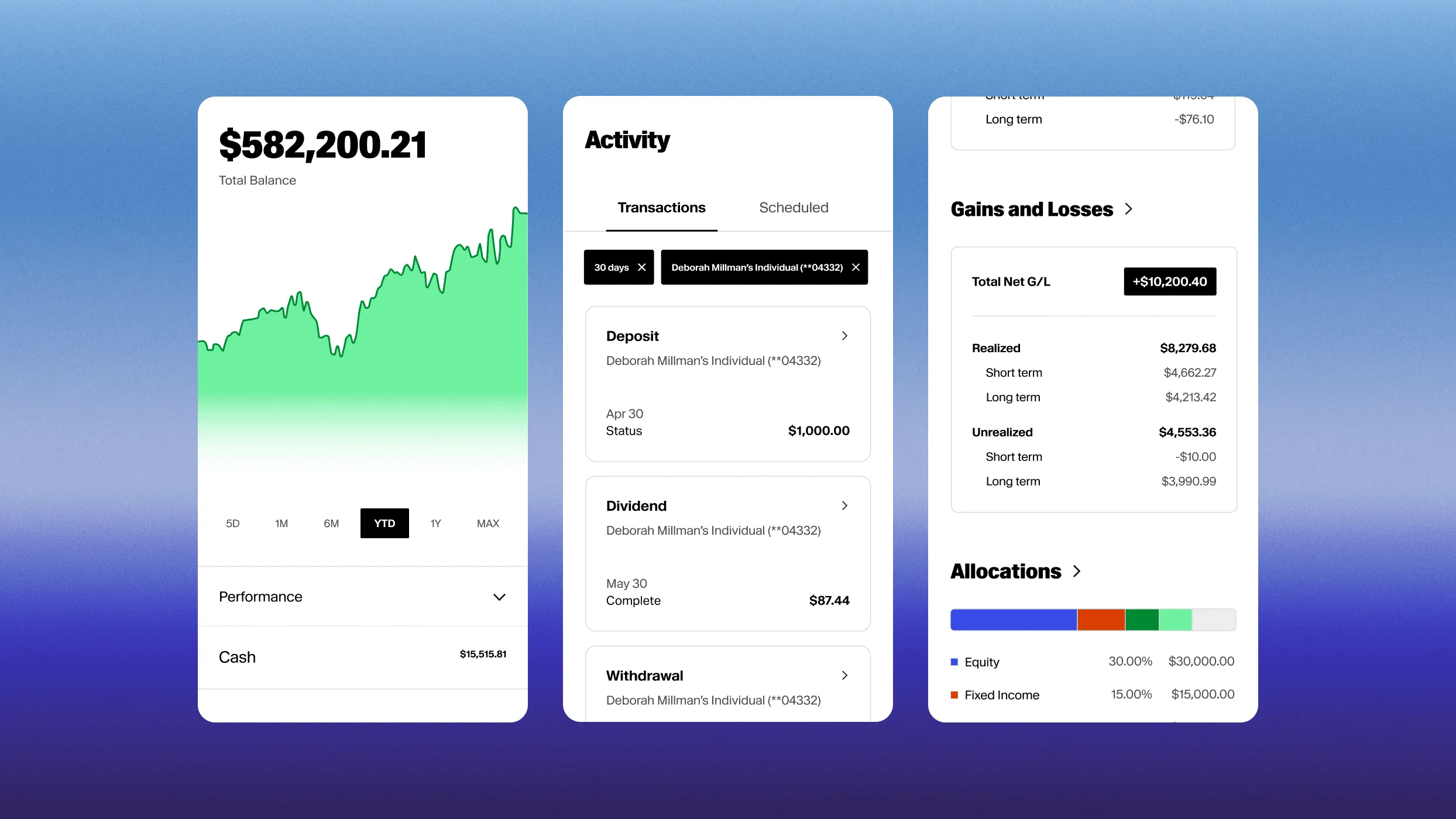

Altruist

Our trusted custodian for seamless, low-cost investment management.